In today’s financial landscape, understanding the equity in your home can be a game-changer. With rising credit card debt and the cost of education, leveraging your home equity might be the key to achieving financial stability.

What is Home Equity

Home equity is the difference between your home’s market value and the outstanding balance on your mortgage. As you pay down your mortgage or as your home’s value increases, your equity grows.

The Growing Trend of Home Equity Loans

According to the MBA’s 2025 Home Equity Lending Study, there has been a significant increase in home equity loans and lines of credit. In 2024, originations rose by 7.2%, with a 10.3% growth in total debt outstanding. This trend is expected to continue, with projections of nearly 10% growth in HELOC debt and 7% in home equity loan debt in 2025.

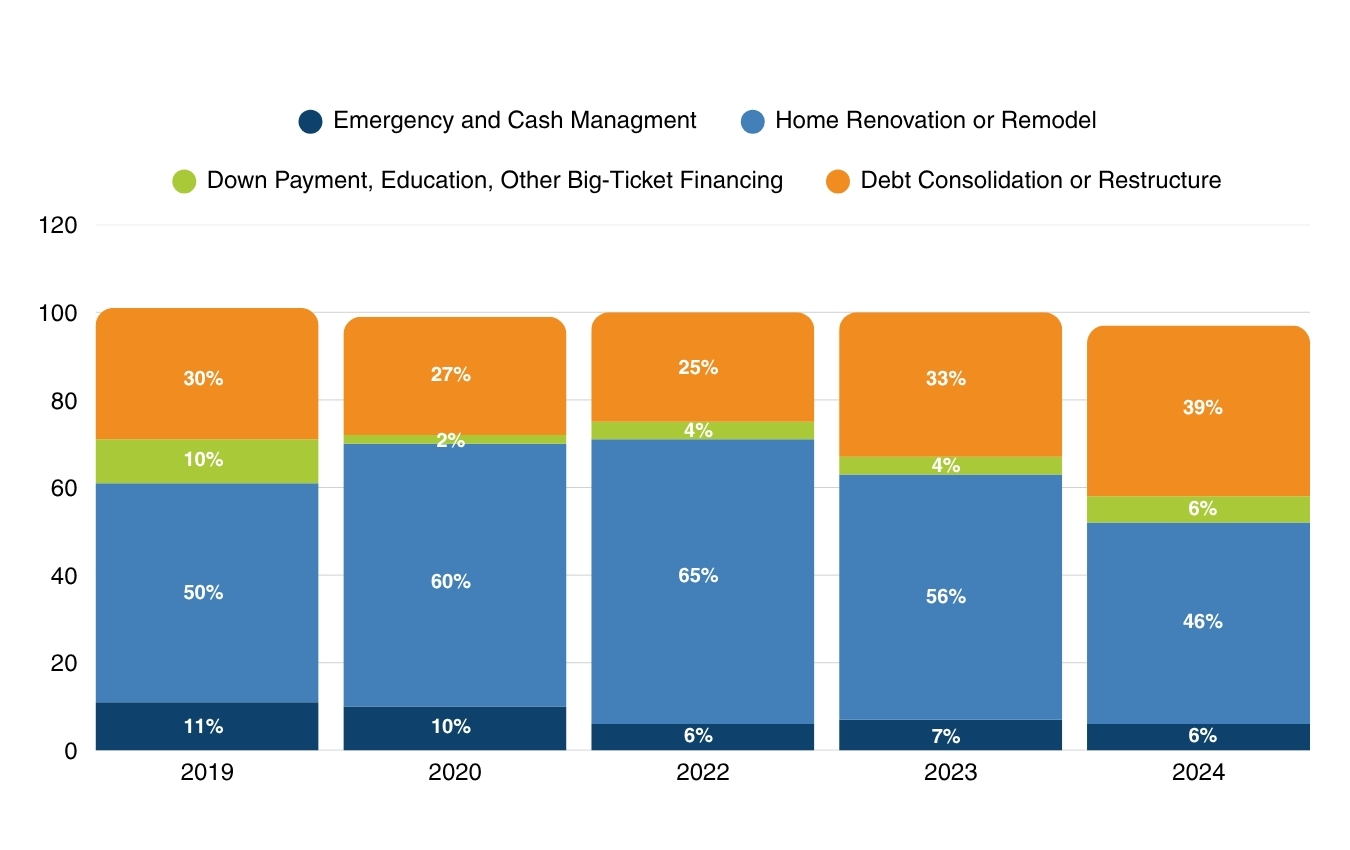

The image above shows that in 2024, borrowers utilized their home equity for various purposes.

- Approximately 39% of borrowers used it for debt consolidation, reflecting a growing need to manage rising non-housing debt.

- Home renovations accounted for 46% of the usage.

- While 6% of borrowers tapped into their equity for emergency cash management and other big-ticket financing, such as education and down payments.

Types of HELOCs

- Variable Rate: Offers flexibility with interest rates that can change over time.

- Fixed Rate: Provides stability with a consistent interest rate throughout the term.

- Interest Only: Allows for lower initial payments by paying only the interest for a set period.

Why Tap into Your Home Equity?

- Debt Consolidation: With non-housing debt, such as credit cards and car loans, increasing by 56% over the past decade many homeowners are using their equity to consolidate debt. This can lead to lower interest rates and simplified payments.

- Education Expenses: As a new school year approaches, many families face the financial burden of college tuition. Using home equity can be a strategic way to fund education without resorting to high-interest loans.

- Financial Flexibility: Whether it’s for emergency cash management or big-ticket financing, such as a second home, your home equity can provide the financial flexibility you need.

Start by connecting with one of our loan officers to discuss which type of HELOC best suits your personal goals.