The Misconception About Mortgage Rates

Many people believe that mortgage rates directly follow the Federal Reserve’s rate cuts. However, this isn’t the case. Mortgage rates often adjust ahead of the Fed’s decisions. By the time the Fed announces a cut, mortgage rates may have already fluctuated, sometimes even rising after the announcement.

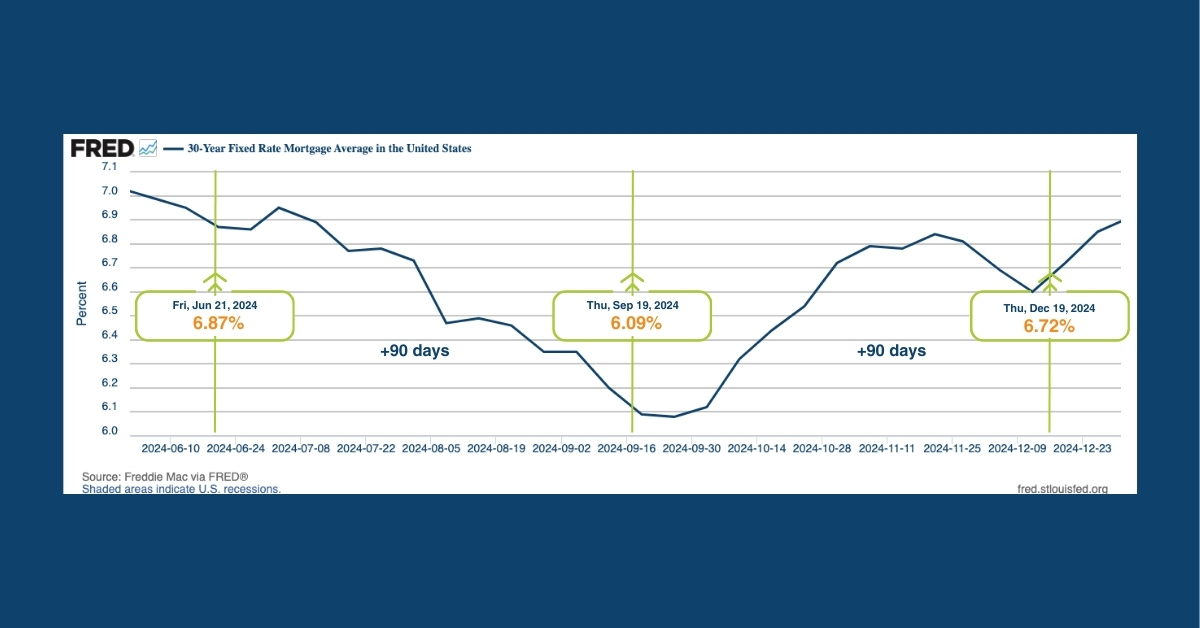

Prime example:

On September 19, 2024, the Fed cut rates, but mortgage rates had already dropped prior to this cut and subsequently increased afterward.

Why Waiting Could Cost You

Market Expectations Matter: Mortgage rates are influenced by market expectations, not solely by Fed announcements. Investors anticipate future moves, which can lead to rate changes before any official announcement.

Opportunities Before the Cut:The best opportunities often arise before the Fed makes a move. If you’re waiting for a cut, you might miss out on favorable rates that are already available.

Historical Trends: Historically, waiting for a rate cut can lead to higher costs in the long run. Rates can rise unexpectedly, and you may end up paying more than if you had acted sooner.

What’s the Smart Move?

Let Us Help You